reverse tax calculator uk

Select Your State Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Nova Scotia Northwest Territories Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022.

How To Calculate Income Tax In Excel

UK PAYE Tax Calculation Spreadsheet Model.

. Other provinces in Canada do not use the HST and instead use a distinct Goods and Services Tax GST andor Provincial Sales. Is the subcontractor registered with HMRC. Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes.

This valuable tool has been updated for with latest figures and rules for working out taxes. Corporation Tax Calculator 2022. FAQ How Do I Calculate VAT Backwards.

Corporation Tax Calculator pre-2015. HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces. Step 1 Get the percentage of the original number.

New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. Tax to be deducted Net Payment Gross Payment London Office. 2000 2500 or 10000.

On the front end of your website you may want this to be clean price or a rounded price for your customers to view eg. The reverse tax calculator calculate net earnings to gross earnings. You can use it for current tax year 2012-13 or previous years.

The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. For example total cost is 118 i need a help for the formula to work back 10099118. This is based on Income Tax National Insurance and Student Loan information from April 2021.

This app is especially useful to all manner of professionals who remit taxes to government agencies. It responds instantly to changes made to gross income and other inputs so just move the gross income slider to see how income tax national insurance bands work alongside pensions and student loan deductions. Overview of sales tax in Canada.

OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price. To find the original price of an item you need this formula. This calculator works on the current United Kingdom VAT rate of 20.

You can use this method to find the original price of an item after a. Most states and local governments collect sales tax on items that. Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax.

Tax reverse calculation formula. In the 20192020 tax year the UK generated 12988 billion in VAT revenue. For example 60 12 UK VAT rate 50 price without VAT Original figure 60 50 price without VAT.

I have a product used to sell for 118 which includes value of the product is 100 9 of CGST tax 9 of SGST tax which equals 10099118. CIS Tax Deduction Calculator. This Excel based calculator calculates Income Tax National Insurance and Net Income for any given value of weekly or monthly or annual salary.

Literally any combination of options works try it - from swapping to. 1st Floor Devon House 171 177 Great Portland Street London W1W 5PQ. VAT is the third largest source of government revenue after income tax and National Insurance.

Instead of using the reverse sales tax calculator you can compute this manually. Take the sum you want to work backwards from divide it by 12 1 VAT Percentage then subtract the divided number from the original number that then equals the VAT. Our CIS Tax Deduction Calculator can assist contractors in calculating the correct deductions to make.

There is no requirement for regular repayments as your house is held as security for the mortgage by your lender with all interest rolled-up during the term and added to your outstanding balance. This calculator is useful if you want to calculate VAT backwards. It uniquely allows you to specify any combination of inputs when trying to figure out what your gross income needs to be for the desired net income.

The calculator takes into account Medicare Levy and the Low Income Tax Rebate but does not take into account other rebates such as the Family Tax Benefits Social Security Rebates. Following is the reverse sales tax formula on how to calculate reverse tax. This is an Excel Spreadsheet Model for calculating UK PAYE Income Tax National Insurance NI.

Step 2 Find 1 of the missing number by dividing the final number by the percentage from Step 1. Now I want to calculate the tax from the total cost. This calculates the amount of CIS Tax you pay.

That means if you have a figure inclusive of VAT Value Added Tax and want to do a vat calculation to remove the 20 VAT then use this reverse VAT calculator. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. If you are managing online shop you will often have to enter your prices excluding VAT in the admin area of your website.

Payment Is the payment Gross or Net. Select the frequency weekly or annual 3. Button and the table on the right will display the information you requested from the tax calculator.

It has also been updated for the VAT reverse charge requirements which apply from 1st March 2021. Reverse UK VAT Calculator How to calculate UK VAT Backwards Forwards or in Reverse. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

See how tax is deducted from your annual salary using this interactive visual income tax breakdown. An online reverse sales tax Remove Sales tax calculation for residents of canadian territories and provinces with high accuracy. A reverse mortgage allows you to release some of the value held within your main UK residence.

Reverse Tax Calculator 2021-2022. Finding the Reverse Percentage of a number in 3 easy steps. If the percentage is an increase then add it to 100 if it is a decrease then subtract it from 100.

This tells you your take-home pay if you do not have. Enter net earnings as weekly or annual. Hungary has the highest VAT rate in the world at 27 followed by Iceland with 255.

As well as entrepreneurs and anyone else who may need to figure out just how. Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases. Rerverse calculator of the VAT in UK 20 5 or 0 free reverse calculator of VAT in United Kingdom in 2022.

The UK business tax section of iCalculator contains tax calculators and tax guides which provide clear details of business tax responsibilities with a view to helping business owners successfully manage their company in the UK. It will work for all types of subcontractors Gross 0 CIS Deduction Net 20 CIS Deduction and Unregistered 30 CIS Deduction.

Mortgage Calculator The Upshot Rent Vs Mortgage Calculator From The New York Times Mortgage Amortization Calculator Online Mortgage Mortgage Calculator Tools

How To Calculate Income Tax In Excel

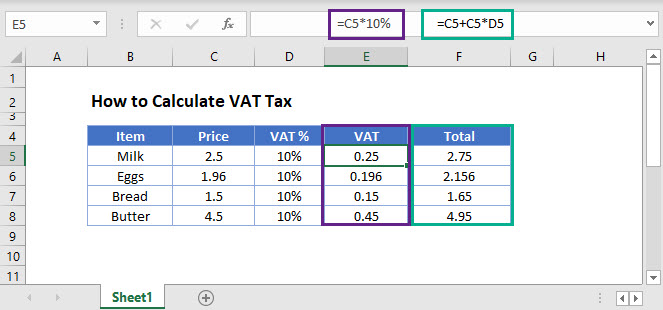

How To Calculate Vat Tax Excel Google Sheets Automate Excel

![]()

Uktaxcalculators World Tax Calculator Uk Tax Calculators

Manitoba Gst Calculator Gstcalculator Ca

How To Calculate Income Tax In Excel

Interest Calculator Interest Calculator Calculator Age Calculator

How To Calculate Income Tax In Excel

Ultimate Corporation Tax Calculator 2021

Mortgage Calculator Free Reverse Mortgage Calculator A Reverse Mortgage Allows Home Loan Pay Reverse Mortgage Mortgage Loan Calculator Mortgage Amortization

Reverse Vat Calculator Calculator Free Online Tools Value Added Tax

Sales Tax Calculator And De Calculator Sales Tax Calculator Tax

Payroll Calculator Payroll Template Payroll Financial Budget

Are You On Twitter Follow Us Https Link Calculatorzen Com Twitter Profile Free Calculators Calculators Twitter New Twitter